2025 - 2026 Income Tax and NI calculator

Welcome to iknowtax.com where you will find Tax and NI calculator containing the latest official tax rates from the HMRC. It allows you to calculate your net income after tax and see what the taxman is taking. You will find an easy to understand table showing the tax rates for 2025 - 2026 and the previous years.

How is tax calculated? I'm confused 😕

You’ve come to the right place! This is your first stop to understand how tax rates work and how tax is calculated. You can start learning from scratch right here. After reading this page, you’ll be ready to search and ask more specific questions on Google with confidence—you’ll know what you’re doing!

Your tax is calculated after deducting your Personal Allowance. Everyone is entitled to a Personal Allowance—unless you earn over £100,000.

Once your income goes above that, your Personal Allowance is gradually reduced until it reaches zero.

Personal Allowance is the portion of your income that is tax-free.

Example:

If your salary is £35,000 per year and your Personal Allowance is £12,500, your taxable income is:

£35,000 - £12,500 = £22,500

You will pay tax only on £22,500.

In addition to income tax, National Insurance Contributions (NICs) are also deducted from your salary

if you're below the State Pension age. NICs are calculated as a percentage of your earnings above £162 per

week (which is approximately £701.94 per month or £8,424 per year).

You can find the rates and thresholds in the tables below.

Personal Allowance 2025/2026

What is Personal Allowance? Personal Allowance is the portion of your earning where tax is not applied, making that portion of your earning tax free.

| Earning | Personal Allowance (per year) | |

|---|---|---|

| If you are earning up to £100,000 | £12,570 | |

| If you are earning between £100,000 and £125,140 | Decreases from £12,570 by 50% of every pound you earn (above £100,000) until it reaches £0 | |

| If you are earning £125,140 or more | £0 |

|

| Blind person receive an additional amount of £3130 on top of the personal allowance | ||

Taxable Income/ Income Tax

Taxable income is your earning where tax can be applied to.

These are some that counts as taxable income: income from employment, self

employment/partnership, pension, investment earning, rental property, state

benefits. For more information visit:

https://www.litrg.org.uk/tax-nic/income-tax/working-out-what-taxable/taxable-income

Tax Rates 2025/2026

These rates apply to different portions of your earnings

Tax rates for Eng, Wales & N.Ireland

| Your earning [per year if you have full standard Personal Allowance] | Tax Rate 2025 - 2026 | That is |

|---|---|---|

| Up to £12,570 | No tax taken | £0 |

| £12,571 - £50,270 | 20% | Basic rate |

| £50,271 - £125,140 | 40% | Higher rate |

| over £125,140 | 45% | Additional rate |

Tax rates for Scotland

| Your earning [per year if you have full standard Personal Allowance] | Tax Rate 2025 - 2026 | That is |

|---|---|---|

| Up to £12,570 | No tax taken | £0 |

| £12,571 - £15,397 | 19% | Starter rate |

| £15,398 - £27,491 | 20% | Basic rate |

| £27,492 - £43,662 | 21% | Intermediate rate |

| £43,663 - £75,000 | 42% | Higher rate |

| £75,001 - £125,140 | 45% | Advanced rate |

| over £125,140 | 48% | Top rate |

Example 1: (You live in England) Salary minus Personal Allowance: £37,500 - £12,570 = £24,930.

So on £24,930, 20% tax rate will apply as you can see on the table above this

amount falls between £0 - £37,700.

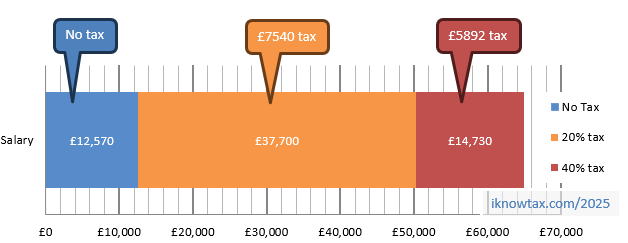

Example 2: (You live in England) Salary minus Personal Allowance: £65,000 - £12,570 = £52,430.

On this amount (£52,430), 20% will be applied up to £37,700 and on the

remaining amount it will be 40%.

Like this: 20% of £37,700 (out of £52,430 (that is £65,000 minus £12,570)), and 40% of £14,730 (remaining of

£52,430 minus £37,700). So the tax paid will be £13,432. See the illustration

below.

Example 3: (You live in Scotland) Salary minus Personal Allowance: £65,000 - £12,570 = £52,430.

On this amount (£52,430), 19% will be applied up to £2827, 20% will be applied between £2827 and £14,921, 21% will be

applied between £14,922 and £31,092, and on the remaining amount it will be 42%.

Like this:

19% of £2827 = £537.13

20% of £12,094 (that is £14,922 minus £2827) = £2419

21% of £16,170 (that is £31,093 minus £14,922) = £3395.91

42% of £21,338 (that is £52,430 minus £31,093) = £8961.54

So the tax paid will be £15,313.58.

National Insurance rate 2025/2026

National Insurance Contribution is payable by everyone, until you have reached the state retirement age. National Insurance pays for your state pension and other state benefits.

These rates below apply to different portions of your earning.

| Your Earning [Per year] |

National Insurance Rate | That is |

|---|---|---|

| Earnings up to £12,570 | 0% | No National Insurance contribution is payable |

| Earnings between £12,570 and £50,270 | 8% | Salary minus £12,570 = X, 8% of X |

| Earnings £50,270 or more | 2% | £50,270 minus £12,570 = £37,700, 8% of £37,700 plus salary minus £50,270 = X, 2% of X |

Below the above table is presented in a different way (it makes it a little easier to see how to apply NI rates on your earning):

| Your Earning [Per year, after subtracting £12,570] |

National Insurance Rate | That is |

|---|---|---|

| Below £0 | 0% | No National Insurance contribution is payable |

| Between £0 and £37,700 | 8% | Salary minus £12,570 = X, 8% of X |

| Above £37,700 | 2% | £50,270 minus £12,570 = £37,700, 8% of £37,700 plus salary minus £50,270 = X, 2% of X |

How to calculate tax?

Here are examples of how Tax and NI is calculated, so you can work out your take home/net pay:

If I earn £8000 per year, how much tax do I pay?

You have a personal allowance of £12,570.

Because your salary is below the Personal Allowance amount, you will not

pay tax:

Salary minus Personal Allowance; £8000 - £12,570 = below £0, so there is no amount left to tax on.

You will also not pay any National Insurance contribution because you are earning below £12,570.

So you keep exactly £8000 per year.

If I earn £20,000 per year, how much tax do I pay?

You have a personal allowance of £12,570. You live in England, Wales or Northern Ireland.

Salary minus Personal Allowance is £7430 (£20,000 - £12,570 = £7430).

On this amount (£7430), 20% tax rate will apply as you can see on the table above this amount falls between £0 - £37,700.

20% of £7430 = £1486.

So the tax paid will be £1486.

You will also pay National Insurance contribution:

Salary minus £12,570 is £7430 (£20,000 - £12,570 = £7430).

On this amount (£7430), 8% NI rate will apply as you can see on the table above this amount falls between £0 - £37,700.

8% of £7430 = £594.40.

NI paid will be £594.40.

So the total tax and NI paid will be £1486 + £594.40 = £2080.40.

Your take home pay will be £20,000 - £2080.40 = £17,919.60 per year.

If I earn £35,000 per year, how much tax do I pay in Scotland?

You have a personal allowance of £12,570. You live in Scotland.

Salary minus Personal Allowance is £22,430 (£35,000 - £12,570 = £22,430).

On this amount (£22,430), 19% tax rate will apply up to £2827, 20% will be applied between £2827 and £14,922, and on the remaining amount it will be 41%.

That is:

19% of £2827 = £537.13

20% of £12,094 (that is £14,922 minus £2827) = £2419

21% of £7,509 (that is £22,430 minus £14,922) = £1576.89

So the tax paid will be £537.13 + £2419 + £1576.89 = £4533.02.

You will also pay National Insurance contribution:

Salary minus £12,570 is £22,430 (£35,000 - £12,570 = £22,430).

On this amount (£22,430), 8% NI rate will apply as you can see on the table above this amount falls between £0 - £37,700.

8% of £22,430 = £1784.40.

NI paid will be £1784.40.

So the total tax and NI paid will be £4533.02 + £1784.40 = £6317.42.

Your take home pay will be £35,000 - £6317.42 = £28,682.58 per year.

If I earn £50,000 per year, how much tax do I pay if I also pay pension?

You have a personal allowance of £12,570. You live in England, Wales or Northern Ireland. You contribute 13% of your salary to pension.

Before tax is applied on this amount, your pension contribution is deducted.

13% of £50,000 = £6500.

So your salary after pension is £50,000 - £6500 = £43,500.

Now, substract Personal Allowance from the amount left after your pension contribution. £43,500 minus Personal Allowance is £30,930 (£43,500 - £12,570 = £30,930).

On this amount (£30,930), 20% tax rate will apply as you can see on the table above this amount falls between £0 - £37,700.

20% of £30,930 = £6186.

So the tax paid will be £6186.

You will also pay National Insurance contribution:

National insurance contribution is calculated on your whole salary (not after your pension contribution).

Salary minus £12,570 is £37,430 (£50,000 - £12,570 = £37,430).

On this amount (£37,430), 8% NI rate will apply as you can see on the table above.

8% of £37,430 = £2994.40.

NI paid will be £2994.40.

So the total tax, NI and pension paid will be £6186 + £2994.40 + £6500 = £15,680.40.

Your take home pay will be £50,000 - £15,680.40 = £34,319.60 per year.

Is NI deducted after taking out tax? NI is not deducted after your tax, or vice versa. -NI is not calculated and deducted on your earning remaining after the tax deductions. The NI calculations are applied to your full amount of your salary.

Any feedbacks are welcome. Please email admin@iknowtax.com

Disclaimer: I am not a tax professional, so please do not use this information to make any big decisions. Do consult multiple professionals when making any big decisions.

the table or rotate phone to view in landscape

the table or rotate phone to view in landscape